Comment on Q1 2024: AI remains in the driver’s seat

Q1 2024 was another solid quarter for global markets. US AI-related stocks once again drove outperformance of developed markets, which returned 9.0%. Emerging markets returned 2.4% (4.1% ex China) and frontier markets returned 5.3%. Our two flagship strategies posted top quartile performance, with our Frontier Markets fund returning 14.4% and generating impressive alpha of 9.0%, and our Global Emerging Market Sustainable (GEMS) fund returning 5.2% with alpha of 3.1%.

AI remained firmly in the driver’s seat for market returns in emerging markets as well, as Taiwan (17% of the index) was the largest contributor to absolute returns, up 14% in the quarter. The largest name in our Global Emerging Markets Sustainable fund is TSMC, which produces all of the advanced AI chips for Nvidia. On its earnings call, TSMC cited AI as it's major growth area, expecting that it will represent a high-teens percentage of revenue by 2027 and that the company sees demand outpacing capacity planning for the foreseeable future. We think the stock remains attractively valued, trading at 16x P/E for 2025, compared with 29x P/E for Nvidia, despite comparable earnings growth (25–28%). TSMC is up 27% YTD, adding USD 138bn to its market cap. Of course, Taiwan is not just TSMC, the smaller chip-related names we invest in also performed very well.

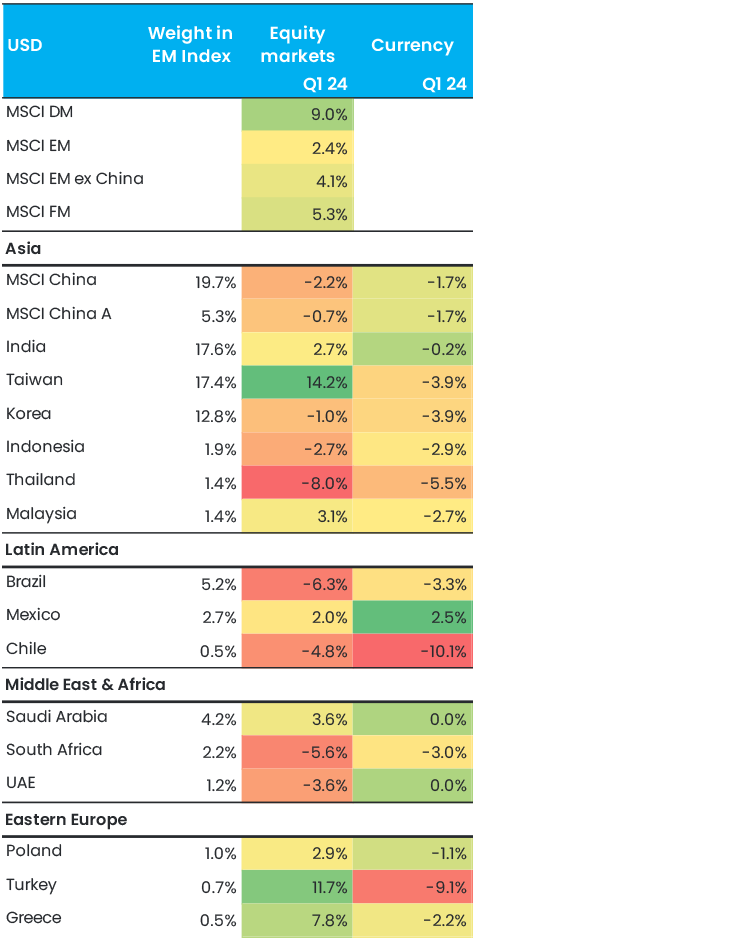

Figure 1. Equity markets and currency returns in USD

Elsewhere, the focus of emerging market investors remains on China, which, at 25% of the emerging markets benchmark, is still the largest country. We are starting to see tentative signs that the equity market might be bottoming, with the MSCI China up 13% from its lows in February. This is partly anecdotal, in that all the investor conferences we’ve been to in China and Hong Kong recently have been much better attended than the same ones last year, with many investors who hadn’t really looked at China before. Jacob Grapengiesser also attended a lunch in Beijing with the CEO of the most renowned American investment bank, whose mere presence indicated that China clearly remains on the radar for global investors and banks.

We also see industrial investment picking up, which is the key driver for growth and one of our preferred investment themes in the country. For example, in January and February manufacturing industrial production was up 7.0% YoY, exports were up 7.1% and manufacturing investment increased 9.4%. Of course, the real estate and consumption data remains weak, and we think it will still take a few months before we start to see this bottoming out, something we think is required for a more sustained and significant rally.

One major theme in China that we think is underappreciated is the pivot of companies on shareholder returns. Over the past decade, the focus has been on raising equity, something that has been highly dilutive for existing shareholders. However, companies are currently focusing on returning capital to shareholders. One high-profile example is Alibaba, which bought back USD 4.9bn of stock in Q1 2024, which corresponds to an 11% yield on an annualised basis. Some of our smaller Hong Kong-listed names are yielding 10–20%, based on combined buybacks and dividends; this is also one of our key engagement themes when speaking to companies, including cancelling the repurchased shares.

One of the highlights of the quarter for us was a fascinating week-long trip to India. It was a somewhat rocky quarter for this market, as small caps sold off significantly after the regulator expressed some concerns about potential fraud, and a few promoters (founders) were caught pumping up their stock through a shady Dubai middleman. This is a good reminder that India is not quite the risk-free ‘only way is up’ investment destination it is made out to be by many asset managers, and it’s important to be highly selective and have a balanced portfolio comprised of the wide range of market caps. Our GEMS fund, for example, has stocks ranging from a USD 282m market cap to USD 92bn. Of course, the conviction on the smaller stocks needs to be very high, so we spent a full day visiting the production facilities and meeting with the management of the largest small-cap name in our portfolio, a recycling company called Gravita. The structural case for recycling remains very strong, and we were interested to explore the high barriers to entry in the sector, which are driving exceptional capital returns (ROIC of around 30%).

Generally, the structural growth story remains incredibly strong in India, with large inflows from domestic investors (USD 50bn per year) significantly reducing volatility in the market, albeit leading to structurally higher valuations. Moreover, the market’s consistently strong performance has meant the weight of India in the MSCI Emerging Markets index has increased from 8% in 2020 to 18%, and hence the country is a key driver of returns.

We also visited Indonesia, where I had a front row seat at a powerful address by President-elect Prabowo Subianto, promising to boost GDP growth to 8% from the current 5%. The country flies under the radar somewhat as the equity market is not particularly developed, meaning it comprises only 2% of the index. However, the country has proved a fruitful hunting ground for us, with our preferred name there – a leading sportswear retailer – up 288% in two years. We expect the index weighting of the country to grow going forward as the capital markets develop, given the exceptional structural growth story.

Frontier markets had another solid quarter, with a continuation of the previous themes such as strength in Eastern Europe and Central Asia. However, it was particularly pleasing to see several challenged markets taking the necessary but painful steps to correct the imbalances in their economies and hence significantly improve their investability. This includes countries such as Egypt and Nigeria, which underwent major currency devaluations and interest rate rises. While we had very limited exposure to these countries, we think they will come back on the radar and potentially offer fertile ground for investors like us.

It was another very busy quarter of travel. In addition to Indonesia and India mentioned above, our investment team was on the ground in Vietnam, Sri Lanka, Taiwan, Dubai and many cities across China. The broad takeaway from all these trips is that the impression one gets is often very different from Zoom calls and reading reports. Of course, many of the companies we meet will not be in line with our clear investment criteria. The few that do are typically those of high quality with strong earnings visibility, though are off the radar for most investors and not covered by the big international banks.

Going forward, we are expecting more of the same in Q2. China will likely continue its meandering recovery, particularly its equity market as investors increasingly start returning to China as they see that the worst is likely over. Indeed, as Ray Dalio wrote recently “the time to buy is when everyone hates the market and it's cheap (which is now the case in Chinese equities)”. We are not necessarily expecting a significant rally, however, until at least Q3, when the property sector, and hence consumer sentiment, starts to stabilise. By that time, all eyes will be firmly focused on what is happening in the US presidential elections. Outside of China, the emerging markets’ structural growth story remains as strong as ever, and we believe there is more to come on the AI theme and have been cautiously building positions in reasonably priced stocks in the sector.

Performance in USD net of fees.

This is marketing communication. This publication is not directed at you if we are prohibited by any law in any jurisdiction from making this information available to you and is not intended for any use that would be contrary to local laws or regulations. Every effort has been made to ensure the accuracy of the information, but it may be based on unaudited or unverified figures or sources. The information in this document should not be considered investment advice and should not be used as the sole basis for an investment decision. Please read the Prospectus and the KID, which are available on the fund pages at www.eastcapital.com