India – the structural growth story of the century or the irrational exuberance of domestic investors?

- The Indian economy is set to grow by 64% or USD 2.5 trillion over the next five years, with certain sectors growing considerably faster, creating ample opportunities for well-managed, disciplined companies.

- Retail investors have been powering the Indian market forward and now own a larger share of the market than foreign investors for the first time in over 18 years.

- 84% of all equity options traded globally are bought or sold on Indian exchanges, almost half of which are traded by individual investors.

- Valuations do look expensive in general, particularly in the small-cap space. However, we believe we can find under-appreciated companies that look reasonably priced given the strong and highly visible medium-term earnings growth.

At East Capital we are very conscious about the risk of “not seeing the woods for the trees”, i.e. focusing so much on individual companies that we miss the bigger picture of what is happening in the markets. Although we are stock pickers, we embrace the fact that markets often have a huge range of drivers beyond the fundamental quality of companies, particularly in emerging and frontier markets.

As such, we spend a great deal of time trying to understand the behavioural factors that are driving returns. In India, the most important narrative is the rise of the domestic investor.

Rise of the domestic investor

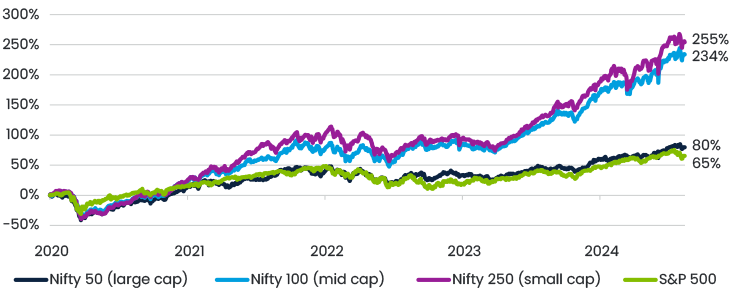

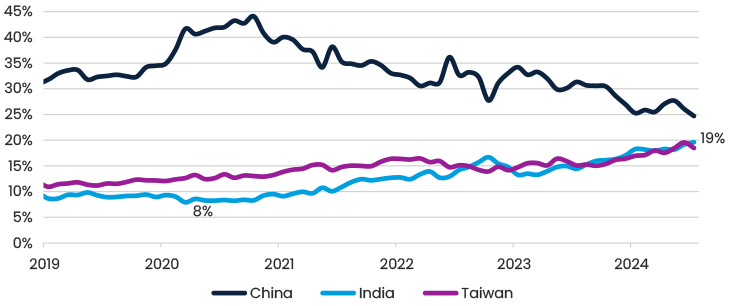

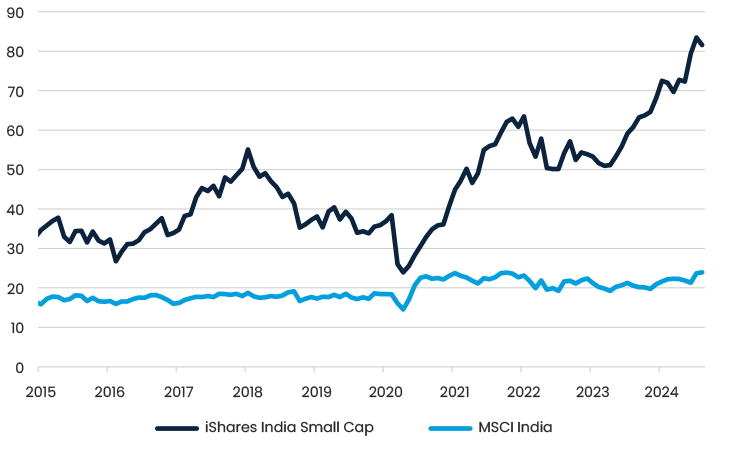

India has undoubtedly been one of the great equity market success stories of the 2020s. Returns since January 2020 have been world-beating, especially when looking at the small and mid-cap space (Figure 1). One direct result of this is that India has now become a much larger part of the emerging market index, from 8% in 2020 to 19.6% currently (Figure 2), and hence a much more important driver of returns than when we launched our fund in 2019.

Figure 1. Return of various Indian indices since Jan 2020 (USD)

Figure 2. India weight in MSCI Emerging Markets Index

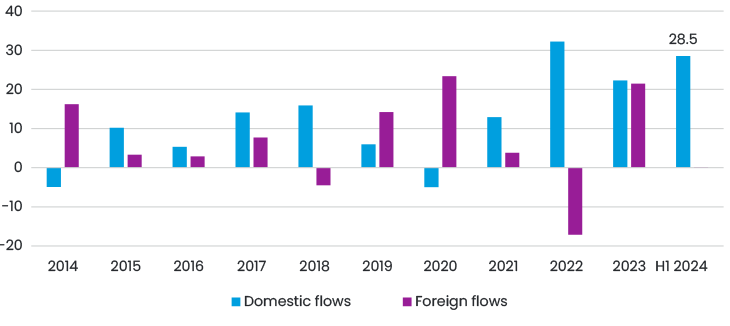

The structural reasons for this impressive performance are well known – strong GDP growth, stable political leadership and a benign geopolitical backdrop. Over the past few years this confidence has seeped into the Indian population, and when travelling around the country, it is striking how much optimism there is about the future. Facilitated by the growth of online brokerage platforms such as Zerodha, this optimism has translated into significant domestic flows, as shown in Figure 3. This trend is accelerating – in the first half of 2024, domestic mutual fund flows were USD 29bn, up from USD 22bn in the whole of 2023. Part of this, of course, is the “virtuous cycle” effect - when people have made money before, they want to invest more, pushing the market further up.

Figure 3. Inflows into the Indian mutual funds (USDbn)

Even more fascinating is the options market. Currently 84% of all equity options traded on the planet are bought or sold on exchanges in India, up from just 15% a decade ago. Driven by an explosion of “finfluencers” and the very limited legal gambling options in the country, individual investors now account for 41% of the index options traded, up from 2% in 2018. This leads to volatility in the market, particularly in the smaller names.

When will the regulator hit back?

Generally, we believe that the biggest risk to the Indian equity market is not related to the economic story, but on the regulatory side, and as such we are closely following any announcements from the financial regulator SEBI. Indeed, the CEO of SEBI recently stated that “There are pockets of froth in the market. Some people call it a bubble, some may call it froth".

We have begun seeing interventions. Early this year the regulator uncovered fraud in two small-cap names (Varanium Cloud and Add-Shop E-Retail) and the involvement of a shady Dubai-based businessman in pumping up the valuations of other stocks. They have also tightened the rules on options trading, requiring stocks to be in the top 500 in terms of market capitalisation and volume in order to qualify, with more sweeping restrictions to come in September. These measures should significantly reduce the volume of options trading, which is not a bad thing for long-term investors like us.

We also saw an increase in taxation in the recent budget, with long-term capital gains tax increasing from 10% to 12.5%, short-term capital gains tax rising from 15% to 20% and a doubling of the transaction tax on options. The market shrugged off these increases within hours as they were not deemed material enough to make a difference.

With the budget now behind us, we don’t see any immediate proposals being discussed that could derail local investors’ insatiable appetite for Indian equities, barring a truly significant global equity sell-off, and while we remain cautious, we see no reason to run for the door.

The structural growth story of the century

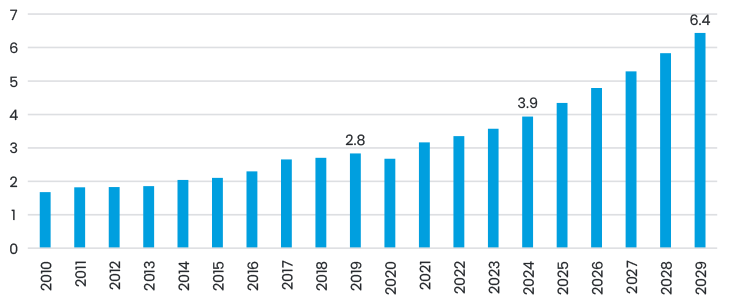

In its latest July Outlook, the IMF again upgraded India’s growth from 6.8% to 7.0% for 2024. Generally, we and others expect this growth to continue, with the latest full IMF numbers (from April) suggesting that the Indian economy could grow by USD 2.5 trillion over the next five years (Figure 4), which is clearly exciting from an equity perspective – the total Indian market capitalisation is USD 5 trillion at the time of writing. While there are risks, particularly related to finding enough jobs for the millions of Indians entering the work force each year, clearly the geopolitical and political backdrop is much more benign than many other emerging countries.

Figure 4. India GDP in USD trillion

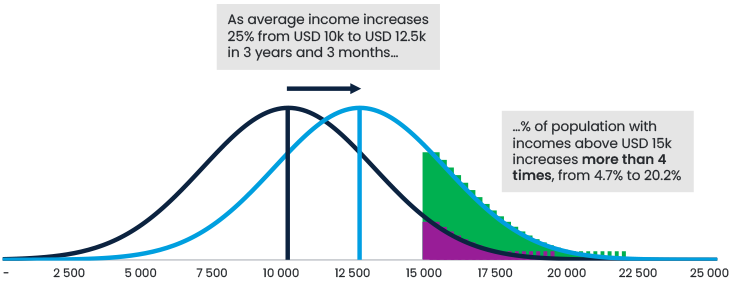

The acceleration phenomenon

As equity investors, one feature that particularly excites us is the acceleration phenomenon. As shown in Figure 5, a 25% increase in income (from USD 10,000 to USD 12,500 in this example) more than quadruples the share of population with an income above USD 15,000. This is the classic “emerging middle class” growth story, and it is driving significant and structural growth in sectors we like, such as financial services and healthcare. For example, India has only 15 hospital beds per 10,000 people, compared with 29 in the US and 43 in China.

Figure 5. The acceleration phenomenon

What is priced in?

Having said this, it is clear that valuations have become extremely stretched, particularly in the small cap space, where the forward valuation for the MSCI Small Cap index is over 80x P/E. This is clearly excessive, and hence we are very cautious when looking at the small cap names, avoiding the expensive stocks and carrying out extensive due diligence on the companies and their promoters.

Outside of the small cap space, this is still an expensive market but we note two fairly unique features:

- The benign geopolitical and political backdrop, combined with strong economic growth, gives us high confidence that certain companies will post earnings growth of 15-20% over the medium term. In other emerging markets, we typically take a shorter-term view on earnings due to much higher uncertainty.

- The growth of a large domestic investor base significantly reduces market volatility as it is less susceptible to large outflows of foreign capital.

Generally, we believe that the “sweet spot” for investing in India is the USD 1-10 billion range (we would call this mid-cap), where we can still find companies that are barely covered by sell-side research, but have a consistent track record of financial performance, strong and disciplined management and reasonable valuations. One example of this would be Nuvama Wealth, a wealth management company that only IPOed last year and therefore doesn’t have much sell-side coverage. The company posted very strong numbers, with latest quarter’s earnings up 133% YoY as its capital markets business grows strongly. The company is targeting 25% growth over the medium term - if this continues for 10 years (which we expect), the company will be 9 times larger in terms of earnings.

Another structural growth story we like is recycling, with high barriers to entry and underappreciated regulatory tailwinds. One of our largest holdings is Gravita, one of India’s leading recycling companies, currently focused on lead and aluminium recycling but moving into other products. Despite strong performance (the company’s share price is up 118% since our initial purchase in September 2023) the company is trading at 33x P/E for this year and 26x P/E for next year and offers c. 25% earnings growth with high visibility.

Figure 6. 12 month forward PE valuations for Indian companies

Conclusion

We would argue that both title questions are true. Yes, India is the structural growth opportunity of the century, but at the same time there is clearly a bit of a bubble going on, particularly in the small-cap space. However, we can find companies that we believe have reasonable valuations given the growth on offer. We are always mindful of having balanced portfolios that include a range of large, mid and small cap stocks, remaining highly selective on the small-cap side.