Comment on Q3 2023: Rising yields mean turbulent times

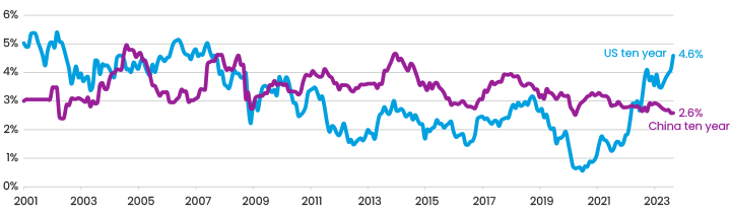

Q3 was another volatile quarter, as the Fed's "higher for longer" stance was priced into the bond markets, with the US 10-year treasury yield surging from 3.8% to 4.6% (Figure 1). This move has significant implications for all asset classes, especially equities with a higher duration (i.e. further out cash flows) or higher debt levels. It’s also a headache for emerging market central bankers, who are keen to cut rates but have to grapple with potential capital outflows and currency weakness, which would further stoke inflation.

Figure 1. US and China Ten Year Treasury Yield

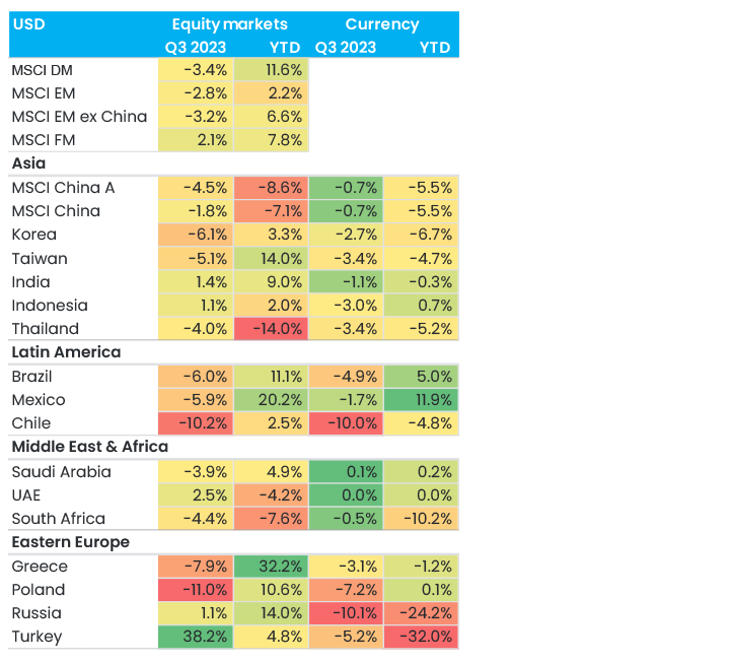

Nevertheless, emerging markets moderately outperformed developed markets in the quarter (Figure 2), particularly in July as the Chinese Politburo finally acknowledged the “tortuous recovery” and pledged to step up stimulus measures. However, enthusiasm waned as investors grew concerned about the lack of concrete measures put on the table.

Figure 2. Equity markets and currency returns in USD

Frontier markets posted positive returns and a solid outperformance compared with emerging and developed markets. The longstanding argument for investing in frontier markets is that they have a relatively low correlation with emerging and developed markets, and hence can reduce the volatility of overall portfolios; this quarter was a classic example of this. The outperformance was even more notable in our East Capital Global Frontier Markets, which delivered 7% alpha in the quarter thanks to strong stock picking and exposure to some smaller emerging markets.

On-the-ground view from china

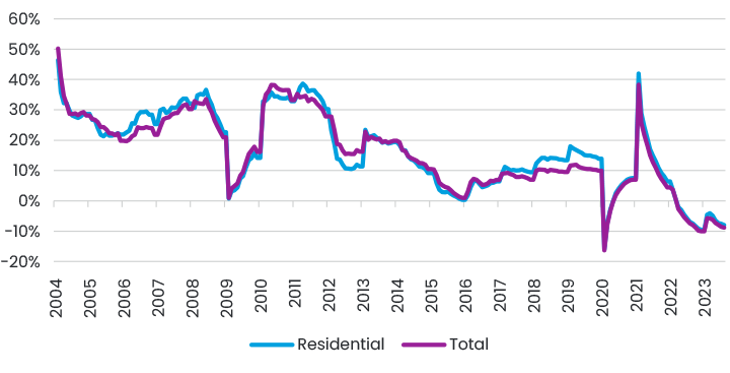

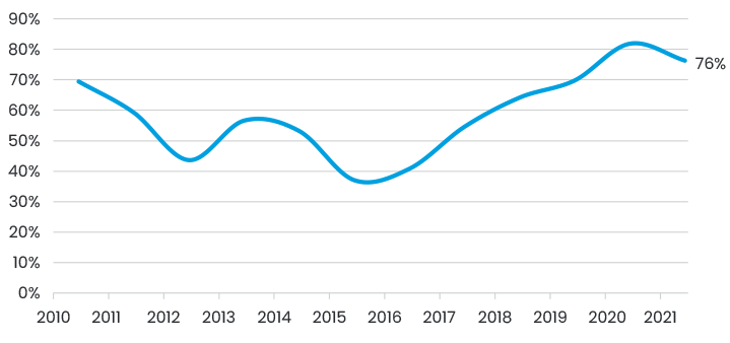

Outside of the US rates environment, the biggest driver of emerging markets remained the China reopening story. I have recently moved to Hong Kong1 and have spent extensive time in China over the last few weeks. While there are tentative (and visible) signs that the economy is bottoming out, China is facing persistent structural issues, particularly in the real estate sector, which has long been a driver of economic growth (see Figure 3). I have been shocked how seemingly unsustainably high house/apartment prices are; in Shanghai, many areas are far more expensive than Manhattan. Additionally, local governments have relied heavily on land sales for financing (Figure 4), leaving them vulnerable to the real estate investment downturn. Households hold an average of 80% of their wealth in residential real estate.

Figure 3. China investment in real estate development, YoY %

Figure 4. China local government revenue from land sales

Towards the end of the quarter, the central government began taking concrete policy actions, such as reducing mortgage lending rates and downpayment ratios. We anticipate ongoing easing measures, but not a sweeping US-style stimulus package. One area we are watching closely is the handling of the USD 9 trillion off-balance-sheet local government debt (‘LGFV’). The first refinancing deal for such debt was recently announced in Inner Mongolia, but there’s much more to address in this regard.

We expect that the economy will stabilise by next year, although we acknowledge that GDP growth will remain in the 3–5% region rather than the 5–7% seen in the last decade (Covid aside). However, this growth will be higher quality, and driven by consumption rather than by inefficient government investment and real estate speculation.

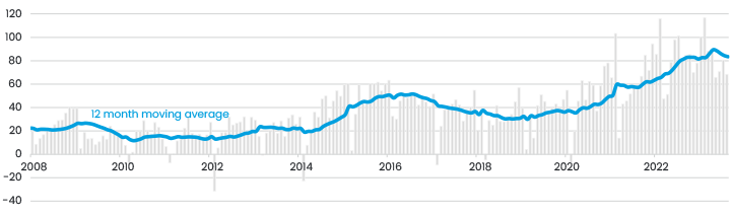

One area that hasn’t slowed down and will continue to drive growth is exports. Indeed, China’s monthly trade surplus has been rising steadily over the last few years, despite various impediments. It was around USD 30bn pre-Covid and is now around USD 80bn (Figure 5). These exports are now high-value-added, with China overtaking Japan to become the world’s largest car exporter in 2023. We have met with many high-quality exporting companies in the last month that dominate some very specific niches; this is one of our key investment themes in China.

Figure 5. China's monthly external trade balance, USDbn

Elsewhere in emerging markets

Elsewhere in emerging markets, the long duration markets of Korea and Taiwan sold off, although India bucked the trend completely to post positive returns. India was recently added to the JP Morgan Bond index after a concerted effort by the central bank to improve the market infrastructure for foreign investors. This should drive USD 20–30bn of inflows into the bond market and drive down yields. Generally, countries like India and Indonesia are much more classical emerging markets, driven by strong economic growth (5–6%) and a rapidly growing middle class. Consequently, they are better insulated from the global headwinds that we see everywhere else in the world.

One of the most interesting markets in the quarter was Turkey, which we visited twice in the quarter. Although it is small in the emerging market index (around 70bps), the country represents 24–30% of our Eastern Europe strategies. As well as a 21.5% hike in the key rate from the bottom in June, which signalled a return to orthodox monetary policy, the main story has been the ongoing retail investment boom, which powered the market to a 38% USD return in the quarter. For example, we were one of two large institutional investors that participated in the IPO of a high-quality children’s retailer, Ebebek, in which 3.9 million retail investors participated, 4.5% of the entire Turkish population. The stock rallied 77% in six days, generating very significant alpha across our Eastern European funds.

The hottest summer on record

On a less positive note, June, July and August were globally the warmest on record by a large margin, serving as a clear reminder about the risks of climate change and also that climate investing is as much an adaptation problem as a transition problem. The TFND (Task Force on Nature-related Disclosures) published its final recommendations, although it will take companies several years to be able to collect and publish full disclosure. For example, GSK, who was a member of the task force, has committed to disclosing a report in 2026, based on 2025 data. We also started to see revised country pledges ahead of the next COP, with Brazil standing out by committing to a 53% reduction in emissions by 2030 relative to 2005, which is more ambitious than the US. We also published our Impact Report2 for our emerging markets strategy, highlighting that carbon intensity is some 49% below the benchmark, as well as explaining how we consider and measure the impact. All these themes (impact, nature and climate) are in the spotlight for discussions at the annual UN PRI conference in Tokyo in early October. East Capital Group's Chief Sustainability Officer Karine Hirn, was part of the global advisory group to shape the agenda and also joined the conference.

We returned from our holidays with a bang, having over 100 in-person meetings in our emerging markets team alone. We have made a large number of portfolio changes across our strategies; we are focusing on a select number of key themes and structural trends where we have relatively high earnings visibility. This includes high-quality exporters in China that have been overly sold off, despite having relatively low exposure to the Chinese economy. We also believe that our GARP (growth at a reasonable price) tilt should help our portfolios ride out the rising yield tide relatively calmly.

Where are we going from here?

Going forward, we expect the rocky ride will continue for investors, with US yields driving a lot of the price action. As we have said previously, economic fundamentals are much stronger in emerging markets than in developed markets, valuations are considerably lower and sentiment (particularly for China) is at an all-time low. This should be fertile ground for emerging markets, although in order to see really significant outperformance we would need to see further stabilisation of China and more concrete data that the economy is picking up. We would also need US yields to peak and maybe even start softening. When this happens will depend on the data, and the market has so far not proven very good at forecasting this. What we are sure of is our investment philosophy and approach, which focuses on reasonably valued, high-quality companies with strong balance sheets that should be able to deliver growth throughout the cycle.