Comment on Q3 2024: The dragon reawakens

Q3 2024 was another eventful quarter for global markets. While the key happening of the period should have been the Fed’s historic jumbo interest rate cut, this was eclipsed in the final week by the Chinese government’s unexpected announcement of an ‘all-in’ attempt to jump-start its ailing economy. Emerging markets once again outperformed, returning 8.7% compared with a 6.5% return for developed markets. This was, of course, driven by China, with MSCI China returning 23.6% in the quarter. It was a standout period for our Global Emerging Markets Sustainable (GEMS) fund, which returned 11.5%, 2.7% above the benchmark. It was also auspicious timing for the rebranding of our China A-shares fund, which we changed to an all China fund in August, as we believed the offshore valuations were too attractive to ignore. The fund East Capital China was up 27.9% in the quarter and has been at the top of peer rankings since the rebranding, which is logical given that we built the fund around unloved but high-quality names that would benefit from a turnaround in China sentiment.

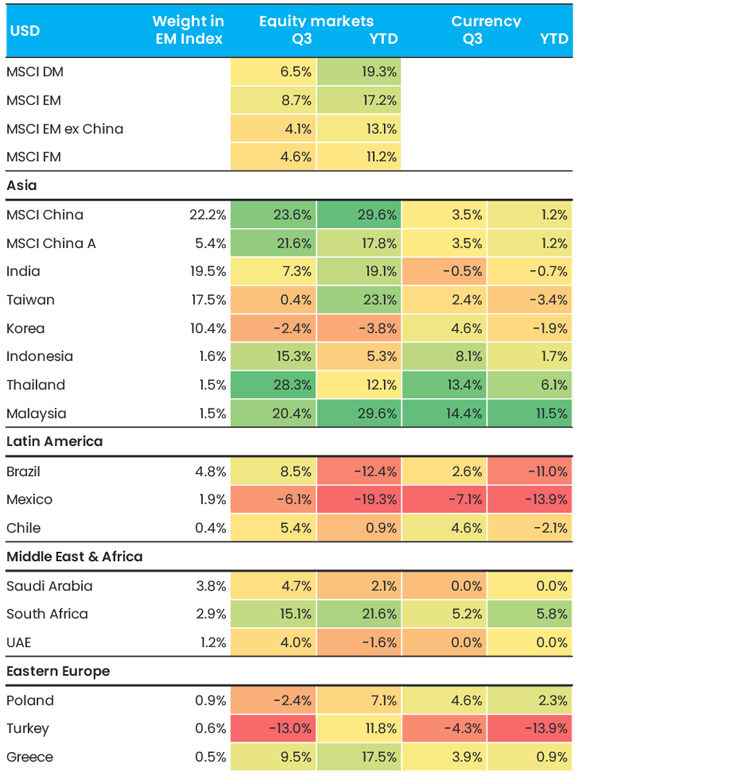

Figure 1. Equity markets and currency returns in USD

Fireworks in China

In September, the Chinese government announced a broad and coordinated policy response to the country’s well-documented economic problems. This marked a significant and unexpected shift from the previous approach of drip-feeding small policy changes. It started on 24 September, when the heads of all the financial regulators held a joint press conference and announced a series of positive measures. These included bank reserve and interest rate cuts, and two new tools to boost capital markets. Two days later, the Politburo issued a strongly worded set of policy directives, key among which were calls for increased government spending through borrowing, “forceful rate cuts” and “stopping the decline of the housing market”. Press reports on the same day suggested the government considered borrowing some USD 140 billion or more to boost consumption and the same amount to recapitalise local banks. This is the kind of cash injection that economists have long been calling for to really start to turn the economy around.

Much of the performance was driven by aggressive short covering, as the sentiment towards China was extremely poor ahead of this, and also by a wave of optimism from Chinese retail investors looking to invest ahead of the Golden Week holiday. Brokers had to stay open 24 hours a day to cope with the influx of new investors, and onshore trading volumes (Shanghai and Shenzhen) hit an all-time high of USD 370 billion, traded on 30 September.

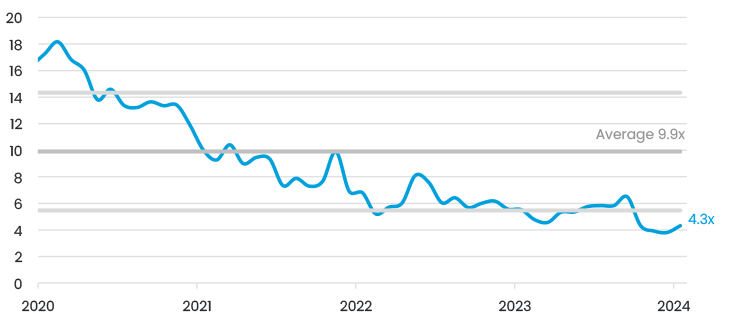

The question, of course, is whether this rally can continue. We remain cautiously optimistic, as we believe the government can and will follow through on the fiscal/demand-side stimulus – probably in the next few weeks. We note that this isn’t something China is completely averse to; we recall the 2008–09 stimulus package, which drove GDP growth to 10%. We also note that the market is still below the peaks of even 2023 and still 41% below the peaks of 2021 (see Figure 2). Valuations are still well below historical averages; see below for Alibaba’s forward EV/EBITDA, which looks reasonable at a valuation of 4.3x, still more than 1 standard deviation below the five-year average. However, we do believe that the market will need to see concrete evidence of this fiscal package before making another significant move higher.

Figure 2. Performance of MSCI China since 2020

Figure 3. 5 year forward EV/EBITDA for Alibaba

Figure 4. 5 year forward P/E for Alibaba

The broader question regarding China is how this will affect the rest of emerging and frontier markets. The sentiment is unequivocally positive, not least because it increases the chances of a ‘soft landing’ globally. However, in order to see a more fundamental impact, we need to see the government succeed in turning the economy around, which is a mammoth task. We have already seen some small moves in key commodities such as iron ore, but there is clearly more to come as construction activity starts to pick up in a more meaningful way.

A quick look at other markets

India also had a solid quarter, briefly overtaking China as the largest market in the MSCI Emerging Markets Index in early September, with both countries at around 22%. This is a big change from 2020, when India accounted for just 8% of the index, compared with 40% for China. While flows from domestic investors have been strong over the past two years, international investors have recently joined the fray. Domestic flows year to date are close to USD 30 billion, and foreign inflows were over USD 10 billion in Q3 alone. Unlike in the US, many of these flows are active, so finding the ‘future investor darlings’, which is our strategy in India, can be a very fruitful approach. This was borne out in Q3, as our Indian holdings in GEMS returned 24.8%, compared with 7.3% for the benchmark. Our alpha generation from India was therefore 3.5%.

Frontier markets remained resilient, despite persistent volatility during the quarter, with the index returning 4.5%. The quarter saw a sharp sell-off in early August, driven by global growth concerns, but sentiment later improved as the Fed initiated rate cuts, sparking a rally in September. Vietnam was the standout country, as investor sentiment improved and the country made significant steps towards emerging market status by removing the pre-funding requirements for foreign investors. While there are a few steps to go, the country could enter the MSCI Emerging Markets index by 2026.

A busy quarter

It was another busy quarter of travel for our investment team, visiting companies in Istanbul, Shenzhen, Seoul, Mumbai, Jakarta, Abu Dhabi and other cities. One of the more interesting events we attended was a conference in London on the Philippines, where we met six companies. The country has been slightly off the radar over the last few years, but it is starting to perform, partly due to rate cuts both domestically and in US. We feel there is more to go, as valuations look reasonable thanks to six years of international selling.

On the sustainability side, we published our H1 2024 Impact Report, which we are happy to discuss in detail with interested investors. It is pleasing to see that many of the key sustainability metrics we focus on are trending in the right direction. For example, due to the small- and mid-cap tilt of our portfolio, we previously lagged behind the index in terms of board gender diversity, which was 14% in H2 2023. Following the AGM season, our portfolio has now jumped to 19%, which is better than the benchmark’s 18%.

Outlook – where do we go from here?

Going forward, falling rates and an improving China provide a very positive backdrop for emerging market equities, at least in theory. Notably, it is not just the US, and China, that are cutting rates. The Fed’s jumbo cut has allowed many EM countries to start cutting as well, with the Philippines and Indonesia being the first to do so in September. This will be positive both for growth and for companies in these countries. However, we can’t ignore the US presidential election, which is still very much on investors’ minds. Although it is still far too close to call, a Harris victory would likely be positive for emerging markets, bringing a more predictable foreign policy and likely a weaker US dollar. However, this is by no means a given, and geopolitics remain an ever-present threat, so we’re focusing on what we’ve been doing all along – building high-quality, robust portfolios that we believe can outperform in a range of scenarios.

Performance in USD net of fees.

This is marketing communication. This publication is not directed at you if we are prohibited by any law in any jurisdiction from making this information available to you and is not intended for any use that would be contrary to local laws or regulations. Every effort has been made to ensure the accuracy of the information, but it may be based on unaudited or unverified figures or sources. The information in this document should not be considered investment advice and should not be used as the sole basis for an investment decision. Please read the Prospectus and the KID, which are available on the fund pages at www.eastcapital.com.