This report sets out the Principal Adverse Impact (“PAI”) indicators according to the EU’s Sustainable Finance Disclosure Regulation (“SFDR”). It then highlights the key metrics the portfolio management team uses to assess the impact of the fund’s investee companies on the surrounding world.

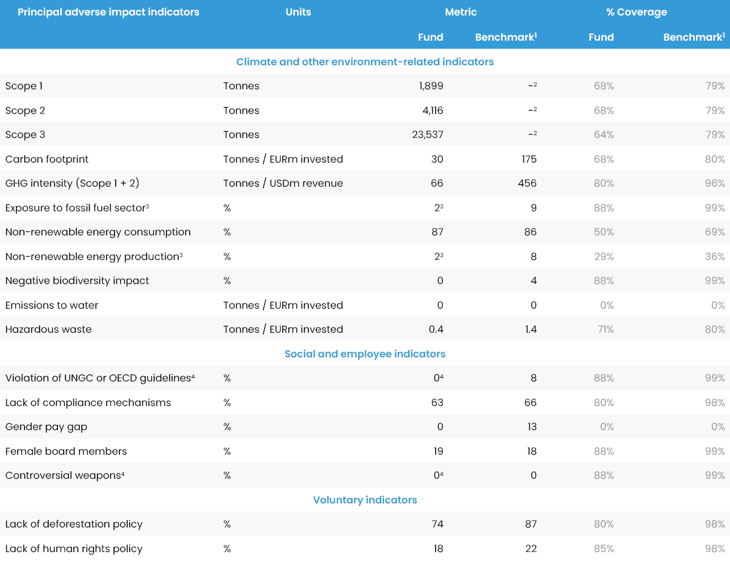

Principal adverse impact indicators

- Our fund’s GHG intensity is 86% below the benchmarks; primarily because we do not invest in fossil fuel companies and because we do consider carbon intensity versus peers as part of the investment process. We would typically not invest in companies with a carbon intensity considerably above peers.

- Our fund‘s exposure to negative biodiversity impact / hazardous waste is nil / very low, we would not invest in such names according to our processes as we actively avoid misalignment with SDGs.

- Violation of global guidelines are part of our exclusion screening process.

- Due to lack of data on gender pay gap in emerging markets, we focus on board gender diversity. Our fund has previously lagged the benchmark, with only 14% of female board members; as such we are pleased that we are now above the benchmark and that the proportion has increased materially, to 19%.

- As a FSDA (Financial Sector Deforestation Action) member, we engage with high risk companies on deforestation issues.

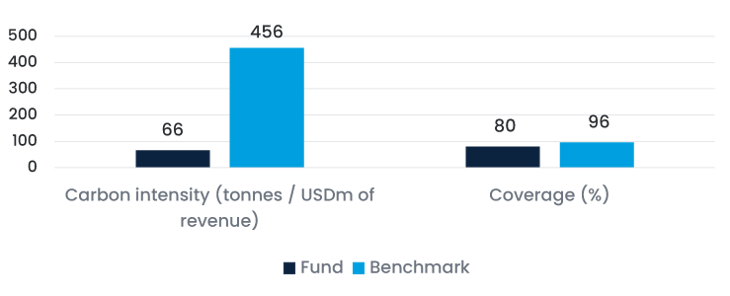

Carbon intensity versus benchmark

- We consider carbon intensity as one standard, easy-to-compare metric when assessing companies.

- Data coverage has been increasing, in part due to engagement efforts from investors like ourselves; for example, we actively participate every year in the CDP Non-Disclosure Campaign to improve environmental data including climate data, targeting all our holdings in the fund which do not report to CDP. See a case study recently published by CDP. Beyond disclosure efforts, we participate in Climate Action 100+ and Net Zero Engagement Initiative.

Case study: SDGs as a lens for structural growth - recycling in India

In March 2024, Portfolio Manager David Nicholls visited the production sites of recycling company Gravita in Jaipur, India.

The company is one of the largest recycling companies in India, with the majority of its revenues coming from lead recycling (mainly vehicle batteries).

Currently recycling is largely done by the informal sector which can lead to negative environmental and social outcomes. This is changing rapidly, driven by legislative changes. During our visit and discussions with company management we learnt about the higher barriers to entry for the business, particularly in sourcing of scrap and the strong regulatory tailwind supporting formalised recycling.

The stock is up 142% YTD. Alpha contribution in 1H 24 was 59 bps.

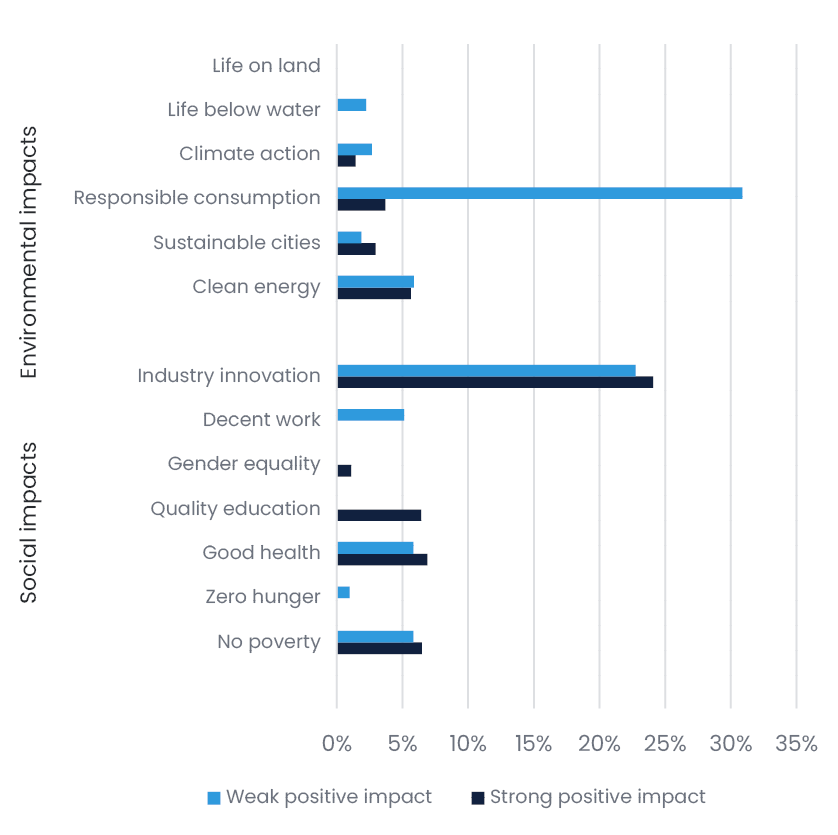

SDG Impact

- We assess SDG impact using a proprietary tool, which is explained in detail in a PRI case study and features as a best practice responsible investment example for China.

- East Capital SDG VCA (value chain analysis) combines revenue exposure and SASB mapping to identify the two most material SDGs for a company’s value chain. The tool gives a score of -100 to 100, based on current impact and 3-5 year outlook. Impact is assessed based on materiality, intentionality, additionality and criticality.

- We currently assess that 55% of the fund has a strong positive impact on one or more SDGs. Because we require a score of above 25 (“weak positive impact”) to be included in the portfolio, 100% of our companies have a positive impact on one SDG.

Case studies

SDG 1: No poverty

Gentera is the leading microfinance institution in Mexico and Peru, providing financial services to the underserved segment in the region. They have been the gateway to the financial system for more than 13 million people.

SDG 3: Good health and well-being

Yatharth Hospitals is a private hospital chain based in northern India that focuses on bringing cutting-edge medical treatments to the smaller cities; for example they performed the first liver transplant in Noida.

SDG 7: Affordable and clean energy

Renew, India’s largest renewable energy company by total energy generation capacity, with a total portfolio of 10.0 GW as of Q2 2024, around 7% of India’s total renewable capacity (excluding hydro).

SDG 9: Industry, innovation and infrastructure

Hyundai Electric is a large transformer producer, which is a key (and undersupplied) input into the electrification value chain. The company is a member of RE 100 and is targeting fully renewable power use in its Korean factories by 2040.

SDG 11: Sustainable cities and communities

Empower, the world’s largest district cooling company listed in Dubai. District cooling is 50% more energy efficient than air conditioning, which is crucial in the UAE where air conditioning accounts for 70% of overall GHG emissions.

Stewardship

During H1 2024, we voted at 41 meetings (89%) of the 46 shareholder meetings where we were able to vote.

In 17 meetings, we voted against some items, such as insufficient gender diversity at board level or overly long board tenure. Our voting is guided by principles defined in our voting policy, part of

our ESG policy, such as insufficient gender diversity at board level or overly long auditor tenure.

Voting is an important part of our active ownership efforts, and we typically follow up with management when we vote against items to ensure they understand the rationale for our actions.

Sustainable Investment Definition

ESG analysis at East Capital is done by the Portfolio Managers and Analysts who cover the companies using robust proprietary tools, such as East Capital ESG scorecard and East Capital SDG VCA.

We classify “sustainable investment" using 3 binding elements that leverage the results of these proprietary tools. These elements are outlined to the right.

As of June 30, 2024 we assess that 94% of the fund is classified as sustainable. There were three companies that did not meet our criteria due to low ESG scores. These holdings, however, met the minimum safeguards to the extent that they comply to our sectorbased and norms-based requirements. We have since then sold out of one of these three holdings. As of this date our cash level was 2.3%, which also cannot be classified as a sustainable investment.

-

Sector based and norms-based screening

I. Companies with >5% of their revenues from fossil fuels, weapons, tobacco, gambling, pornography and alcohol;

II. We also use a third-party provider to check for breaches of UN Global Compact. -

SDG VCA tool of at least 25

I. This ensures companies have a net positive impact on the SDGs - we have removed 6 companies due to too low a score and screened out many more. -

Company is classified as sustainable as per our “three step test”

I. Contribution to E and/or S >60% score in E&S section of ESG scorecard. II. No significant harm to E or S No red flags related to E&S issues and compliance in screening. III. Good governance practices >60% in G section of ESG scorecard and no more than 2 red flags related to G.

1 MSCI Emerging Markets Index. No specific index has been designated as a reference benchmark for the purpose of attaining environmental or social objectives.

2 We do not report data for the benchmark because this is an absolute measure that is related to the size of the fund, i.e. owning 1% of a company with 100 tonnes of Scope 1 emissions would result in 1 tonne of Scope 1 emissions attributable to the fund.

3 This relates to a port management company whose fossil fuel exposure is insignificant (i.e. less than 5%) and purely for internal use.

4 While coverage by the data provider is below 100%, our investment and screening processes imply full portfolio coverage on this parameter.

Documents & links